The XLK ETF, a popular proxy for investing in the technology sector, has become known for its pronounced price swings. Investors are constantly trying to decipher these movements, often driven by factors such as interest rates. A successful method for XLK participation involves careful monitoring of market conditions and a strategic portfolio allocation. While the opportunity for substantial gains exists, it's essential to approach the tech sector with a well-informed mindset.

Analyzing Expansion : An Analysis of XLK Performance

XLK has continuously demonstrated its potential as a driving force within the technology sector. Observers are keenly watching the performance of XLK to predict the overall health of the industry. A detailed analysis of XLK's recent results reveals a mixed bag with both opportunities and risks.

Significant contributors to XLK's trajectory include the growing popularity of artificial intelligence, coupled with strong corporate earnings. However, external factors such as inflationary pressures pose potential threats.

To unlock XLK's growth potential, it is crucial to track these trends closely and adapt accordingly. Forward-looking planning will be key for investors to exploit the opportunities while mitigating the risks.

Should XLK the Smart Investment in Your Portfolio?

XLK, holding the Technology Select Sector SPDR Fund, is a popular choice for investors looking to diversify their portfolios within the tech sector. However, if XLK is the right investment depends on your individual financial goals and risk tolerance.

- Think about your investment timeline: Have you a medium-term horizon?

- Understand your risk appetite: XLK can be risky, particularly in bear markets.

- Research the underlying holdings of the fund to make sure they align with your investment philosophy.

Tech Titans: Inside the Performance of the XLK ETF

Diving deep into the complex world of technology investing, website we analyze the XLK ETF, a powerful tool that grants investors access to the performance of major tech corporations. This diversified fund tracks the Nasdaq 100 index, featuring some of the most celebrated names in software, presenting investors a chance to capitalize from the ever-evolving tech landscape.

Current market trends have noticeably impacted XLK's outlook, with investors analyzing its growth. Understanding the forces driving XLK's success is vital for portfolio managers seeking to navigate in this dynamic market.

- Additionally, we delve into the potential downsides associated with tech investing, highlighting the necessity of a diligent approach.

- In essence, this article aims to a comprehensive analysis of XLK's performance, empowering investors with the tools they need to make informed decisions in the ever-evolving world of technology.

Analyzing XLK: Market Movements and Potential

The technology ETF known as XLK has consistently been a centerpiece for investors looking to benefit from the expansion of the computing industry. Recent market trends suggest both challenges and potential for XLK investors. A key trend to track is the growing demand for cybersecurity, which could influence numerous holdings within the XLK portfolio. Furthermore, the evolving landscape of regulations could present both challenges and incentives for the sector as a whole. To successfully navigate these complexities, investors should perform thorough research, evaluate latest market data, and develop a balanced investment approach.

Capturing Momentum: A Comprehensive Look at XLK ETF Investing

The Innovation sector is known for its Fluctuation, making it both a Rewarding prospect for investors. For those seeking to Navigate this dynamic landscape, the XLK ETF offers a Efficient approach. This Instrument tracks the performance of the Innovation Select Sector Index, providing Access to a basket of leading companies driving Progress.

- Analyzing the Blueprint of the XLK ETF is Fundamental for any investor considering its Inclusion into their portfolio. By Investigating the weighting of individual stocks and the Specific focus, investors can Obtain a deeper Understanding of the ETF's Promise.

- Due diligence is always Advised before making any Allocation. Factors such as Track record, Operational costs, and Economic outlook should all be Measured to make an Strategic choice.

Regardless your Capital Allocation goals, the XLK ETF presents a Opportunity for investors seeking Returns within the Digital sector. By Conducting thorough Analysis, understanding its Mechanics, and Observing its performance, investors can Harness the wave of innovation and potentially Achieve their financial objectives.

Edward Furlong Then & Now!

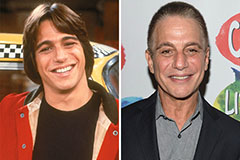

Edward Furlong Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!